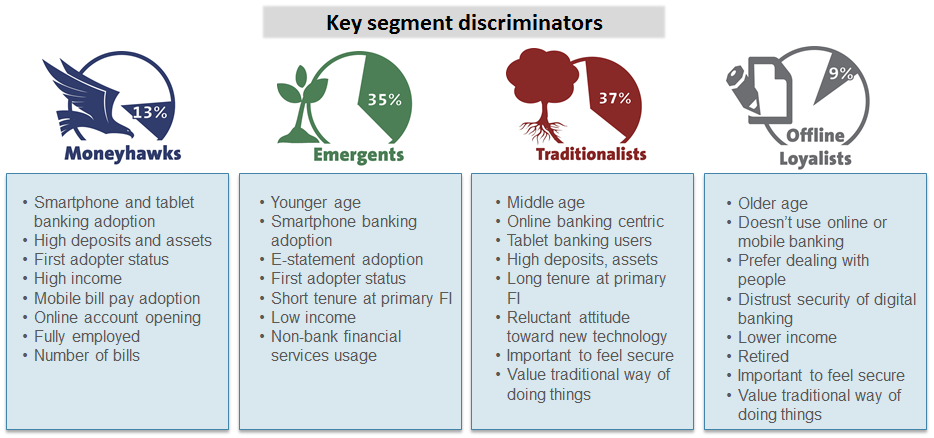

I recently had the pleasure of presenting at a Financial Services webinar with Mark Schwanhausser of Javelin Strategy & Research. We talked about the “Convenience Conundrum of Digital Banking” where easy, 24/7 access puts Financial Institutions (FIs) at risk of losing personal touch and becoming a commodity. I talked about how mobile messaging solutions can help redefine the personal banking experience by targeting key market segments that Mark identified. Javelin has done a great job segmenting buyers based on demographics, behaviors and attitudes for the FIs as shown below.

I especially like their Moneyhawks® and Emergents segmentation since as Mark said, mobile messaging can be used the help with the evolution to deepen financial services role from just providing status type of messages to offering insights and then advising the individual customer. One example he shared was their preference for receiving fraud alerts via text messaging.

Mark shared research data on channel usage that demonstrates the importance of providing an omnichannel customer experience that requires integrating channels rather than eliminating them. Mobile banking and online banking are the two channels expected to grow while other traditional channels like IVR and ATM are expected to decline, but they won’t become obsolete anytime soon.

I shared some SMS statistics as a customer engagement channel compared to other channels:

- SMS is the most frequently used aspect of the mobile phone

- Nearly 100% of US mobile subscribers have SMS bundled in their plans

- 64% prefer SMS over voice for customer service

- 81% of consumers are frustrated being tied to voice calls for customer service

- 90% of SMS messages are read within 3 minutes

Given the reach of SMS and that the vast majority of Moneyhawks, Emergents, and even Traditionalists know how to view and send SMS messages, FIs need to be aware that Enterprise to Person (E2P) messaging is growing. I shared the following consumer demand research findings that OpenMarket conducted:

- Consumers attempted to send more than 400,000 SMS messages to Fortune 100 toll-free numbers during a one-year period

- Over 50% of the total attempted messages were sent to financial services companies

- 5 of the top 10 Fortune 100 companies that received the most messages were financial services companies

The conclusion: Consumers want to text their financial services companies using toll-free numbers even though this isn’t a supported channel!

The above research shows why there is growing adoption by enterprise businesses in text-enabling their toll-free numbers to be able to send and receive standard rate messaging. Additionally, the US carriers are even discussing enabling Free To End User (FTEU) Texting on text-enabled toll-free numbers.

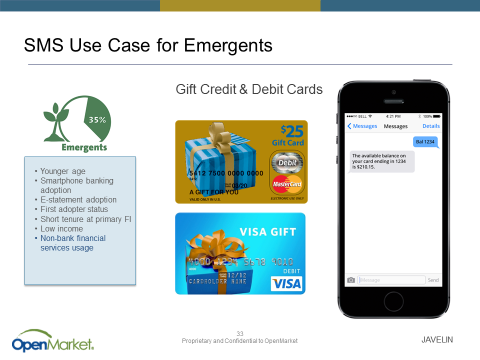

One of the examples that I shared for how to apply mobile messaging to target a specific customer segment is the following:

Together, Mark and I offered 4 recommendations:

- Redefine personal banking by initiating “conversations” and letting customers start them, too, by text-enabling your customer service toll-free phone numbers.

- Use mobile messaging to upgrade customer service chat and self-service and position your Financial Institution as an advisor and financial watchdog.

- Serve the mobile-first mind set by supporting self service solutions with live agents as well as natural language processing.

- Converse with your highest-value customers in the channels they prefer and consider most effective.

To learn more, you can watch the complete webinar here. If you are interested in knowing how many customers attempted to text your company’s toll-free number, contact us here. Lastly, if you want to learn more about E2P messaging, you have the option to either call us or text E2P on our toll-free number 877.277.2801 for a white paper on this topic – your preference.